Your credit score plays an important role in your financial life. It impacts your ability to get approved for loans, credit cards, and other lines of credit. It can also influence the interest rates you pay. That’s why it’s important to understand what goes into calculating your credit score and take steps to build and maintain good credit. One question many people have is whether paying their cell phone bill can help build their credit.

How Credit Scores Are Calculated

The most commonly used credit scores are FICO scores, named after the company that created them, Fair Isaac Corporation. FICO scores range from 300 to 850. In general, the higher the score, the better.

FICO scores are calculated from the information in your credit reports from the three major credit bureaus – Equifax, Experian, and TransUnion. The following factors influence your score:

- Payment history (35%): Whether you make payments on time. Late payments can lower your score.

- Amounts owed (30%): How much you owe compared to your credit limits. High balances can lower your score.

- Length of credit history (15%): How long you’ve had credit. Longer histories tend to help.

- New credit (10%): Opening new accounts may lower your score initially.

- Credit mix (10%): Having different types of credit (credit cards, loans, etc.). Variety helps.

As you can see, payment history has the biggest impact at 35% of your total score. Timely payments are crucial for building strong credit.

Do Phone Bills Help Your Credit?

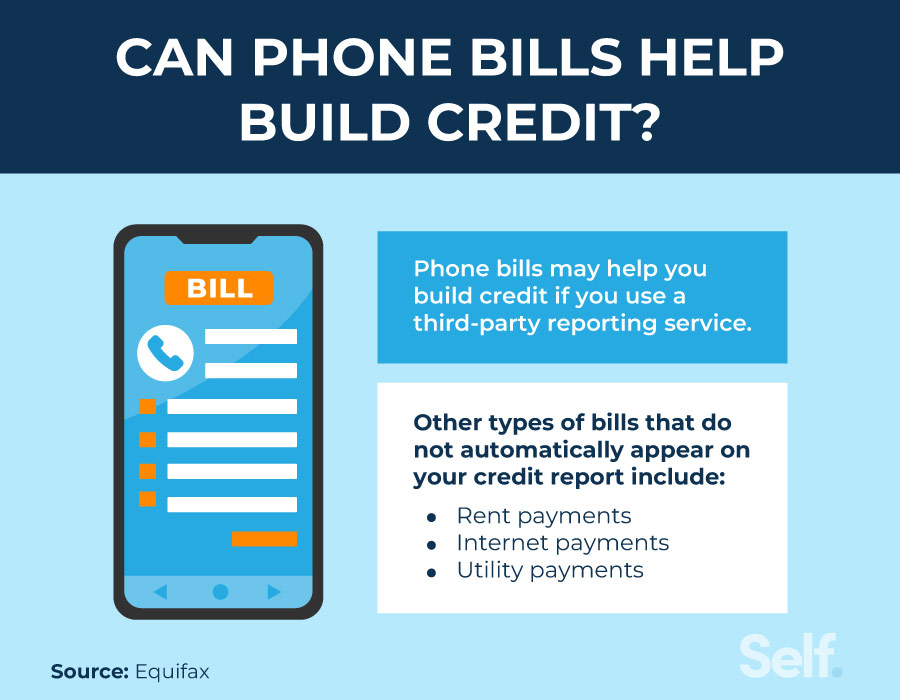

In most cases, simply paying your monthly phone bill does not directly help your credit because phone companies don’t report your regular on-time payments to the credit bureaus. However, there are some nuances to understand.

Missed Payments Hurt Your Credit

While on-time payments aren’t reported, missed payments can negatively impact your credit score. If you become delinquent on your phone bill, your provider may report this to the credit bureaus, damaging your credit.

Cancellation Fees Impact Credit

If you cancel your phone contract early, you will likely owe an early termination fee. If you don’t pay this, it could be reported as a delinquent account and hurt your credit.

Hard Inquiries From New Service

When you sign up for new phone service, especially if you finance a phone, the provider will likely do a hard credit inquiry. Too many hard inquiries in a short period can lower your credit score temporarily.

Reporting Positive History Manually

While phone companies don’t automatically report your on-time payments, services like Experian Boost allow you to manually add this positive payment history to your credit reports. Adding 24 months of on-time payments can help build your credit.

Using Credit Cards to Pay

Another option is to pay your phone bill with a credit card. Since credit card payments are reported to the bureaus, this allows your phone payments to indirectly contribute to your credit profile as you build positive payment history on your card.

Tips for Using Your Phone Bill to Build Credit

If you want your phone bill to help improve your credit, here are some tips:

- Pay on time – Late payments get reported so always pay by the due date. Set up autopay if it helps.

- Consider reporting payments – Adding your history with Experian Boost can build your credit, especially if you have little other credit history.

- Use a credit card – Pay with a card but be sure to pay your statement balance in full each month.

- Limit hard inquiries – Too many credit checks from new services can temporarily lower your score, so be selective.

- Pay early termination fees – If you cancel service early, pay fees promptly to avoid potential credit damage.

- Monitor your credit – Keep an eye on your reports and scores to ensure your phone account status doesn’t inadvertently hurt your credit.

The Impact of Cell Phone Financing

Another consideration is financing your cell phone directly through your provider or the phone manufacturer rather than buying it outright. In general, these financing plans do not help your credit score.

However, if you finance through the phone manufacturer, it may involve a credit check and reporting of payments, which could impact your credit similar to a credit card. Read the terms carefully.

Financing through your provider via a monthly installment plan typically doesn’t require a credit check or report your payment history. While easier to qualify for, it won’t build your credit profile.

Building Credit Takes Time

Building good credit takes time and responsible financial habits. Pay all your bills on time, keep credit card balances low, and limit new credit applications. Monitoring your credit reports and scores lets you see where you stand. While your phone bill alone doesn’t build your credit, paying it on time and avoiding delinquency helps maintain a healthy credit profile.